THE DIGITAL FUTURE

Leading up to the Dotcom Crash of 2000, we heard a significant amount about how the future was going to be different and that investing had changed. Companies were going public with minimal capital and little chance of ever being profitable. The Crash happened, and those companies disappeared, much as has happened every time the investment community utters the words “this time it’s different.”

However, if you look at what has happened in the two decades since the crash and its aftermath, there has in fact been significant change, and much of it was not even contemplated by the folks who predicted a digital future. The following graphs were created by the company Global Macro Investor and the commentary by its founder Remi Tetot is incorporated into this analysis.

BIG DATA

We all know that data has grown substantially. The graph below shows that over the past 10 years, data usage has grown from just over one Zettabyte in 2000 to projected to be over 80 Zettabytes for 2021. We have computing moving from on-location mainframes to the cloud and the level of automation advanced to previously unforeseen levels.

Investment implications: cloud storage companies and those that provide software and processes to make work and personal life more digitally advanced and automated will be the megacap stocks in another ten to twenty years. Stocks that today are barely known will be household names that you wish you bought in 2021. Palantir and Snowflake are two of the more widely known names today, but lesser-known names like UiPath that provides robotic process automation which allows robots to emulate human behavior will have wide moats and massive revenues (and hopefully actual earnings per share and free cash flow that will enrich their shareholders much like Google, Microsoft and Amazon’s cloud services today).

SATTELITES

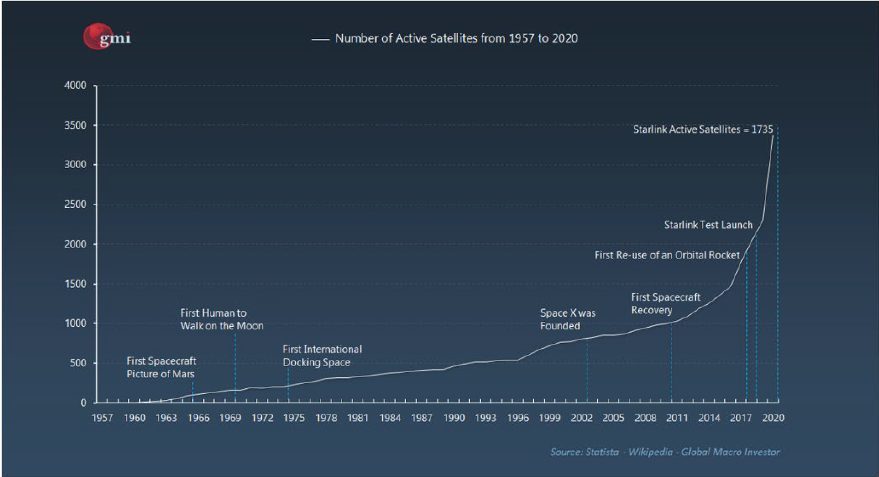

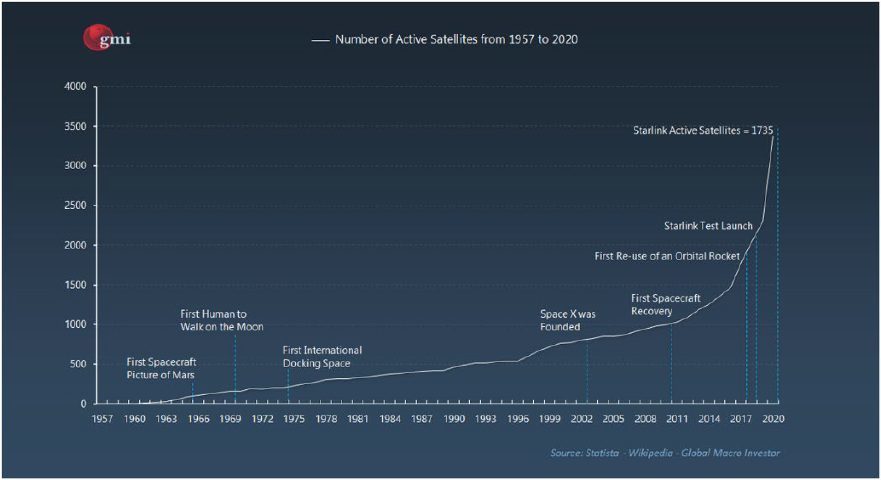

Space exploration will become increasingly important as satellites will be critical to the expansion of networks needed to handle data processing and transmission. There is a reason that Jeff Bezos, Elon Musk and Richard Branson (the three most forward thinkers of our time) have all put billions of dollars into research on space travel and satellite deployment capabilities. They have a vision for what the future will look like, and they are preparing for it now.

The graph above shows the growth of satellites from 1957 to 2020, while the graph below shows projections for just SpaceX satellite deployment forecast through 2030.

Investment implications: traditionally, the large aerospace defense companies would give you exposure to satellites, like L3Harris and Kratos. However, for a more modern take on this we again could look at Palantir whose meta-constellation software provides Artificial Intelligence capabilities to 237 companies in the industry.

5G WIRELESS COMMUNICATIONS

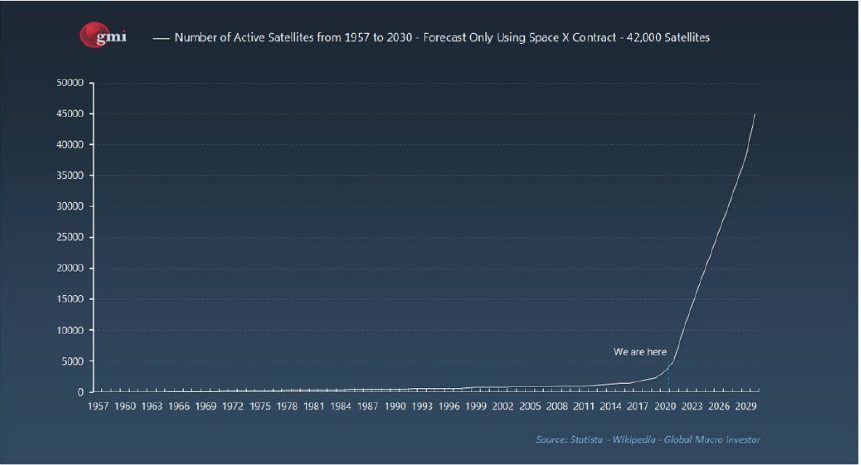

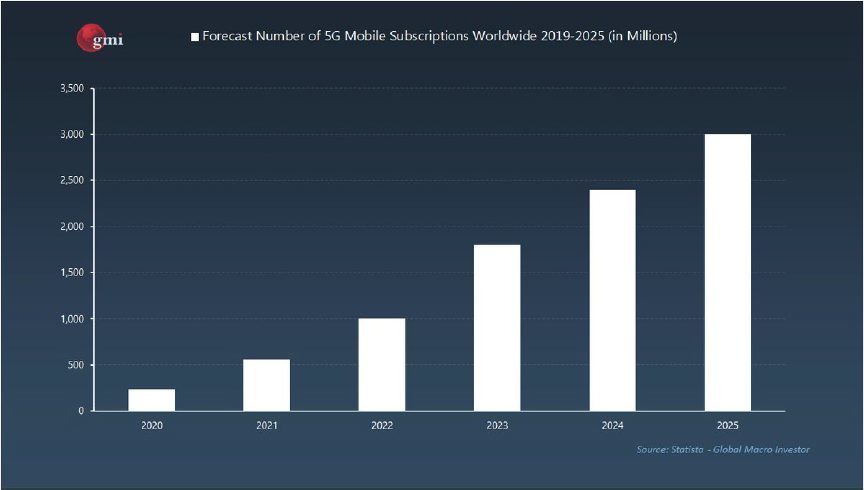

Inherent in the satellite trend is the upcoming 5G wireless revolution. The improved technology will allow for significant advances in more than just person to person communication as the “Internet of Things” moves quickly forward – devices all around us will become “smart” and interconnected to our daily life and with each other.

The graph below shows you the forecast for worldwide 5G mobile subscriptions through 2025.

Investment implications: we have had 5G exposure in client portfolios for a couple of years now, companies like Skyworks Solutions, Qualcomm, Qorvo, and Broadcom that provide components for smart phones, American Towers that provide the cell phone towers, and Uniti Group that has the largest supply of unused fiber optics lines.

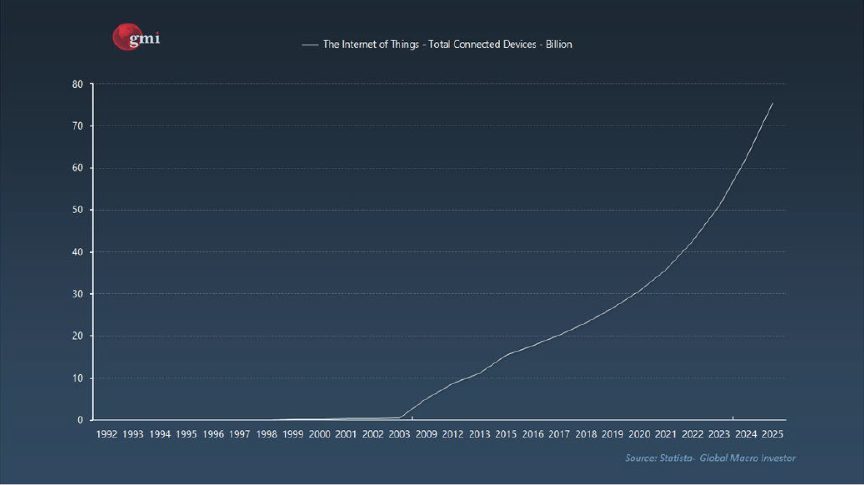

INTERNET OF THINGS

he Internet of Things is already all around us. We have everyday devices that connect to the internet, sending and receiving data in a steady stream. Even though I refuse to connect my washing machine to my home wifi, it has the ability to connect to the internet and be operated via an app on my phone. I’ll bet your car is sending data to its manufacturer with details about its operating status – I know that I periodically get text messages from General Motors telling me that I have reached a mileage that requires a certain service or that one of my tires has low air pressure. The advances in 5G and Satellite deployment will make this ubiquitous in our everyday lives.

The graph below shows you the projected growth of the Internet of Things through 2025.

Investment Implications: this may be one of the most widespread of the topics discussed here – many traditional companies that you are familiar with operate in this space, like Hewlett Packard, Intel, Oracle and Microsoft. However there are others, like NXP Semiconductor that you may or may not know about that are big players in this field of providing automobiles with smart capabilities.

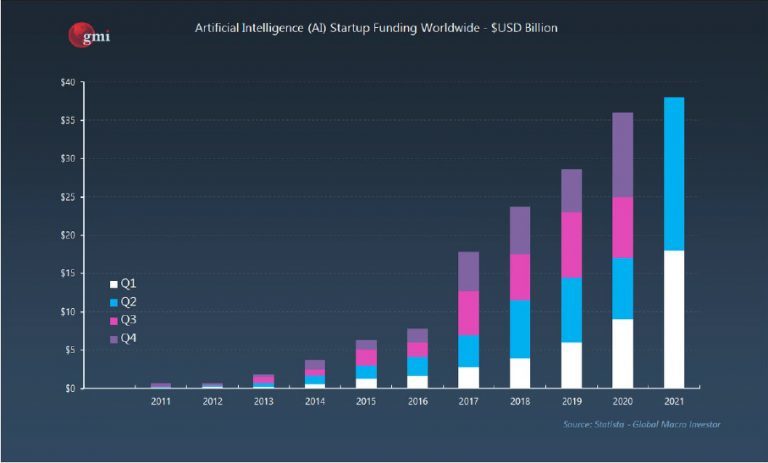

ROBOTICS & ARTIFICIAL INTELLEGENCE

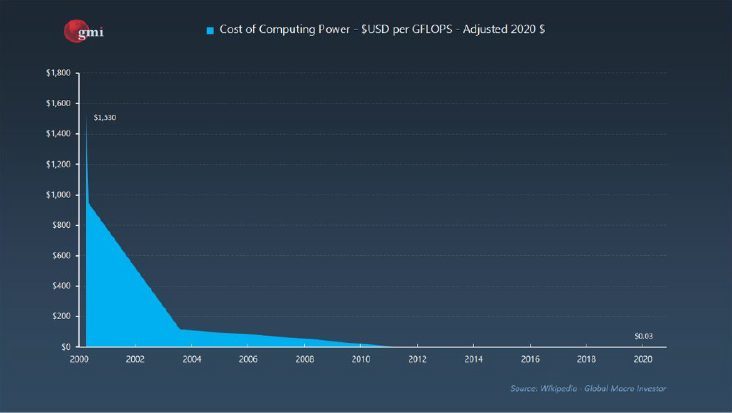

The next major step forward in computing power is machine learning. As chip makers continue to develop semiconductors that can learn, the robotics Industry will continue to grow. As machines grow to handle new situations based upon application of past experience and programming, industry will become more efficient and show increased margins (albeit from the removal of human workers from parts of the process).

Over time, the cost for artificial intelligence will fall making it more prevalent and applicable to small and midsized businesses. The graph below shows you how the cost for computing power has trended to zero per “gigaflop” over the past twenty years. A gigaflop is a unit of computing speed equal to one billion floating-point operations per second. As that cost continues to trend down, adoption of artificial intelligence will flourish.

Investment Implications: the graph below shows the increase in investment capital that has flowed into companies that tackle various parts of the artificial intelligence business. Money enables innovation, and companies that have the ability to develop products that improve processes or further automate robotic solutions have the opportunity grow into megacap corporations like Google and Microsoft.

Nvidia, Palantir and Snowflake are examples of newer names in the investment world whose products are advancing the abilities of artificial intelligence. However it is not just prevalent in the tech and industrial world; medical research companies like Astra Zeneca are employing artificial intelligence in their work to develop new medicines and treatments.

MEDICAL TECHNOLOGY

Astra Zeneca using AI to advance their R&D is just one example of what is happening in the medical industry to employ advance technology.

Genome sequencing is on area that has seen significant advancement in the past two decades. The graph below shows you a comparison of R&D cost to generate a single genome sequence to the number of genome sequences that have been identified. The greater the number of genome sequences identified the more likely it is that science will be able to discover not just the causes of diseases like cancer, but what can be done to prevent them.

Investment Implications: there are publicly traded companies working in this area, with the best known being Illumina, Pacific Biosciences, and CRISPR. We do not have positions in any of these yet, but they are on my watch list.

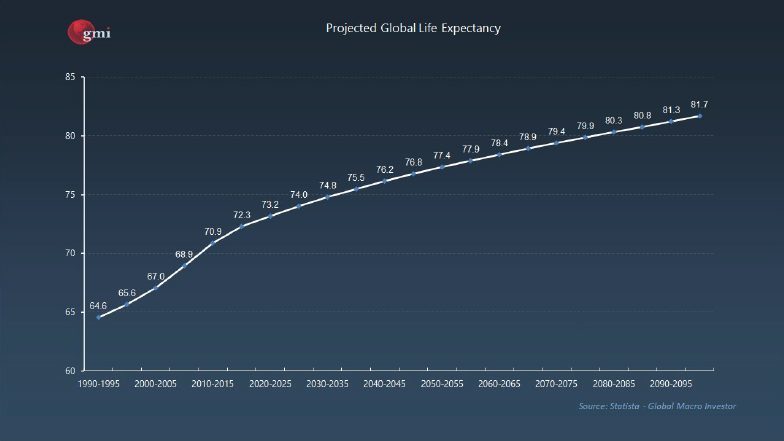

Other medical advancements are coming from companies like INmune Bio that is working to reprogram the body’s immune system to combat Alzheimer’s Disease; Shockwave Medical that has pioneered a process called Intravascular Lithotripsy to clean out arteries and prevent heart attacks and strokes; Leap Therapeutics developed a process to treat cancer by inhibiting tumor growth and using the immune system to kill the cancer cells; and InMode Ltd that developed a minimally invasive technology for aesthetic healthcare to perform liposuction, skin tightening, body and face contouring, with the goal being less pain and faster recovery. Each of these companies has a niche in a specific growing market and may or may not be the big winner. They are, however, leaders in their fields at the present time.

Advancements in medical technology have a direct impact on life expectancy. In the graph below, you can see the path of global life expectancy through the end of the century. The companies above will be a part of that advancement or there will be new entrants to the markets that will improve upon their processes and products to become the dominant players.

This raises questions about the ability of the planet to generate adequate food and water to support the increase population resulting from increased longevity, but the next section touches on the food aspect of that.

BLOCKCHAIN

Most people associate blockchain technology with Bitcoin, the most famous user of it. However, it is much more than a platform for digital assets.

In its simplest form, blockchain technology allows for distributed computing where thousands of different computer networks work together to achieve a computing goal, where the benefit is that if one network fails, the entire system continues on without fail. The power of blockchain is that different tasks within a computing goal can be happening on different networks, exponentially expanding the computing power available to the user.

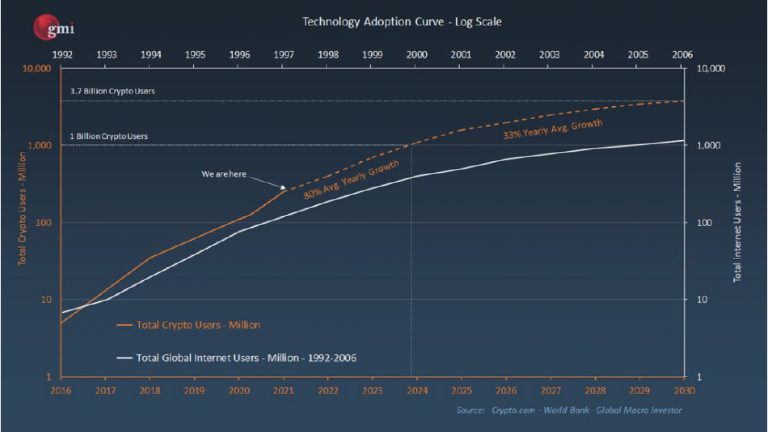

Digital currency has been one of the initial uses for blockchain technology since each participating network has a copy of digital currency transactions and balances. Below is a graph that shows the adoption of cryptocurrency projected through 2030.

Digital currency is just the tip of what blockchain will impact – below are some examples from 101 Blockchains of current systems that could be positively impacted by blockchain technology to help solve problems:

• Healthcare: transparent system for healthcare that allows for better communication of treatment protocols and coordination of available beds during crises/pandemics, among other things

• Supply Chains: better coordination of goods flowing through the system as businesses can pinpoint exactly where a product is in the process and whether they need to find an alternate source before a shortage becomes a major problem

• Food Supply: tracking food from the farm to the processer to the distributor to the store or restaurant, being able to maintain quality control and supply management – this will be critical, along with advance in farm technology (not discussed in this analysis) to keep the food supply increasing in step with the increasing population resulting from longer lives

• Power Grid: improved process for wholesale energy distribution and peer-to-peer energy trading that can improve pricing for consumers and improve continuity of service

Investment Implications: this is a difficult one – many of the companies working in this area are not yet publicly traded. However, blockchain has moved from the theoretical stage to the implementation stage with companies and systems deployed in several fields today, meaning it is only a matter of time before companies move from venture capital stage to IPO’s. Below is a list from 101 Blockchains detailing functional areas where blockchain systems are in use and the companies providing the technology:

- Content management/distribution: PeerNova, Brave.

- Data management: Factom, Essentia.one.

- Cybersecurity: GuardTime, Remme, Blockverify, PeerNova.

- Platform: Gem.

- Healthcare: SimplyVital Health, MedRec.

- Financial Services: Abra, Barclays, Aeternity.

- Manufacturing and industrial: Maersk, Provenance, SKUChain, LO3 Energy.

- Storage: STORJ.io

- Government: SouthKorea’s project, Govcoin, Democracy.earth, FollowMyVote.

- Retail: OpenBazaar, Loyyal.

- Blockchain platform: IBM Blockchain solutions, Decent.

- Transport and Tourism: Arcade City.

- Media: KodakOne, Ujomusic, Civil.

- RealEstate: Ubiquity, Propy.

- Land Registry: Public Registry.

- Identification: Uport.

- Insurance: AIG.

- Enterprise: Azure.

- Advertising: NYIAX.

- Authorship and ownership: Blinded, Stampery, Veisart, Po.et.

- Social Network: AKASHA, Yours.

- Diamonds: DeBeers

GREEN ENERGY AND ELECTRIC TRANSPORTATION

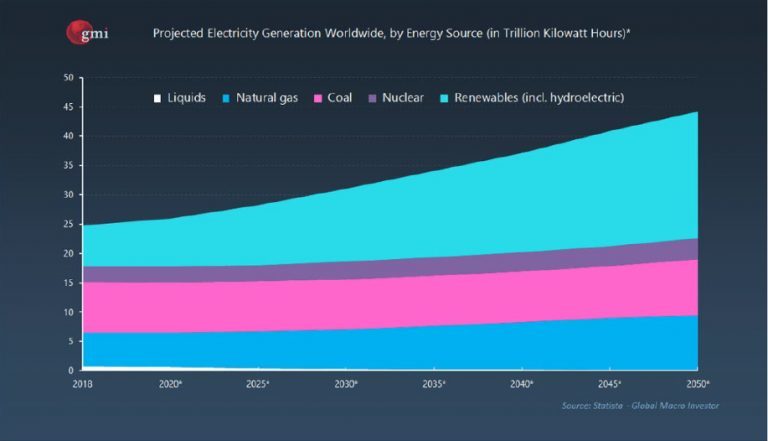

The graph below details the projections through 2050 for the sources of electricity production. This appears to be a relatively realistic projection as it shows current sources continuing to grow but at a significantly slower pace than renewables. The one that I think they are underestimating is Nuclear, but that is a debate for a different write-up.

Investment Implications: in the near-term, traditional energy has to be a part of a diversified portfolio, but renewables are a growing factor. From solar companies like First Solar and SolarEdge Technologies and to large conglomerates like Honeywell and General Electric that have gotten into the space, our portfolios have exposure to renewables.

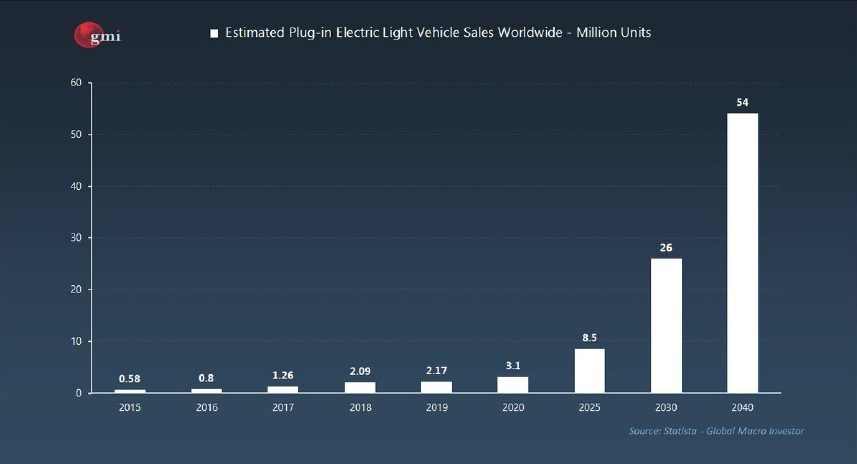

However, the real push is in electric vehicles. The graph below shows the projection of electric vehicle sales through 2040.

Investment Implications: we currently have exposure to electric vehicles through: vehicle production and parts with Ford and Borg Warner; batteries with Compass Minerals; and charging stations with Blink Charging. The companies entering this market is growing exponentially, and significant amounts of money are going into building out the charging networks, so expect that we will increase exposure in due course.

We also have exposure to alternative fuels companies that are not in the EV space with biofuel company Darling Ingredients (who take restaurant cooking oil waste and convert it to biodiesel) and hydrogen fuel cell maker Plug Power whose products are used in delivery vans and long-haul trucking.

In the early stages of development, electric air travel is on the horizon. The leader in it is a publicly traded company from Germany, Lillium NV, that focuses on R&D in Electric Vertical Takeoff and Landing technology for highspeed air transport of people and cargo. They have their technology deployed in Brazil as a test market, and from what I’ve read it is progressing according to plan. This is a company on my watch list that could be added to client portfolios.

METAVERSE

Nvidia’s blog addresses this concept: “What is the metaverse? The metaverse is a shared virtual 3D world, or worlds, that are interactive, immersive, and collaborative. Just as the physical universe is a collection of worlds that are connected in space, the metaverse can be thought of as a bunch of worlds, too. [Initially the metaverse was] Massive online social games, like battle royale juggernaut Fortnite and user-created virtual worlds like Minecraft and Roblox, reflect some elements of the idea. [However, real world uses are now being developed, like ] Video-conferencing tools, which link far-flung colleagues together amidst the global COVID pandemic, are another hint at what’s to come…

“The metaverse will become a platform that’s not tied to any one app or any single place — digital or real, explains Rev Lebaredian, vice president of simulation technology at NVIDIA. And just as virtual places will be persistent, so will the objects and identities of those moving through them, allowing digital goods and identities to move from one virtual world to another, and even into our world, with augmented reality. The metaverse will become a platform that’s not tied to any one place, physical or digital. ‘ “Ultimately we’re talking about creating another reality, another world, that’s as rich as the real world,” ‘ Lebaredian says.

“Those ideas are already being put to work with NVIDIA Omniverse, which, simply put, is a platform for connecting 3D worlds into a shared virtual universe. Omniverse is in use across a growing number of industries for projects such as design collaboration and creating “digital twins,” simulations of real-world buildings and factories.”

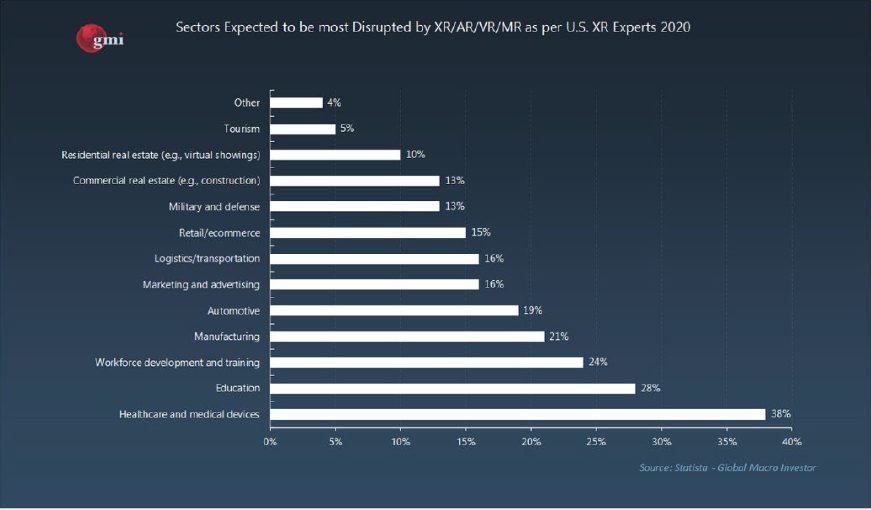

The blog post from Nvidia makes it seem more theoretical than possible. Augmented Reality and Virtual Reality are becoming a larger part of everyday life, expanding beyond apps that are already available in the iPhone App Store, expanded beyond the gaming space, and is expected to be used in a number of practical applications.

The graph below details projections of which will be impacted by the disruptive technologies that will help define the Metaverse:

Investment Implications: companies like Apple, Google and Facebook already are at work on Metaverse applications, but other companies like Autodesk (provider of automated drafting software that now incorporates metaverse features in its architecture, engineering, and construction design software) are taking the concept and applying it to business uses. There are also emerging growth companies like Twillio and Unity Software that provide the software backbone for these disruptive technologies that form the infrastructure of the Metaverse.

To give you a feel for how big the Metaverse is likely to become, Facebook announced this week that they are rebranding themselves as a Metaverse-focused company with a new name to be announced soon.

Finally, I owe a hat tip to Puru Saxena for his writings on emerging growth companies and how to successfully manage a portfolio of them as I get ideas for my own further due diligence from those writings.

SUMMARY

Our Growth Stock Portfolio Strategy incorporates many of the companies discussed above. These breakthrough technologies will be critical parts of our future and the companies discussed may or may not end up being the next Google or Amazon – remember at one time Netscape, MySpace and America Online were considered the standard bearers for the digital transformation of the world. However, sometimes the pioneers in an industry do not end up being the winners as new entrants build upon earlier successes and innovate beyond what the pioneers imaginer or the growth they were able to fund.

Because of this, I keep a set of fairly strict rules when investing in emerging growth companies:

- Revenue growth must exceed 15% annually, and the earlier the company is in the development of the technology the higher the threshold. Lillium NV discussed above is not yet a candidate for purchase as their revenues do no meet this benchmark;

- The company needs to be the leader or a critical player in the industry;

- The founder must be present and actively participating in the company. We do not own Pinterest in client accounts, but if we did I’d be a seller this week based upon the co-founder leaving the company for a different venture. I also get concerned if the CFO jumps ship; and

- The company must focus on its core business and have moved beyond the emerging stage before they start acquiring companies outside their knowledge base that do not have express synergies or vertical integration with their core business. We previously owned Isreal’s Fiverr International, an online retail platform for sellers. Previous acquisitions allowed them to vertically integrate applications to expand the core platform. This week they announced the acquisition of an online education company – this is a red flag and I’d likely be a seller if we hadn’t previously booked profits in this company.

Investing has different purposes for different individuals. It can be for safety in a fixed income portfolio, it can be for income in a dividend stock portfolio, or it can be for wealth creation in a growth stock portfolio (you also get wealth creation from dividend stocks – but the big capital increases come from identifying and owning emerging growth companies that come to dominate their industries and potentially become the next megacap.

Having exposure to emerging growth stocks is important for a long-term growth portfolio; you don’t want the entire portfolio to be composed of them as they are too volatile and do not fit into traditional valuation models, but owning the next Google of Amazon is the catalyst for real wealth creation.

If you have an interest in our managing your investments using the concepts discussed in this blog post or previous ones, you can contact me at [email protected] and we can discuss it.

–Mark

Disclosure: do not invest in any of the companies described in this blog post without doing your own due diligence. My writing about them is not an investment recommendation and you should not buy them just because I wrote about them. I owe a hat tip to Puru Saxena for his writings on emerging growth companies and how to successfully manage a portfolio of them as I get ideas for my own further due diligence from those writings.