RECAP

In the first post of this series, I discussed the stock and bond markets’ performance for the year and compared that to our Model Portfolios upon which client portfolios are managed. Today, I want to talk a bit about why 2022 was a stock pickers market and why I believe that 2023 and beyond will be the same.

A STOCK PICKER’S MARKET

For many years, particularly since the end of the 2008-09 bear market (but really since the beginning of the bull market in BONDS) investing was fairly easy. Yes, there were times when the market would hiccup and it required skill to own the right stuff (remember the NASDAQ Crash and the post-911 bear market, among others?), but generally you could own an index fund and beat most investment managers (other than BankChampaign, of course).

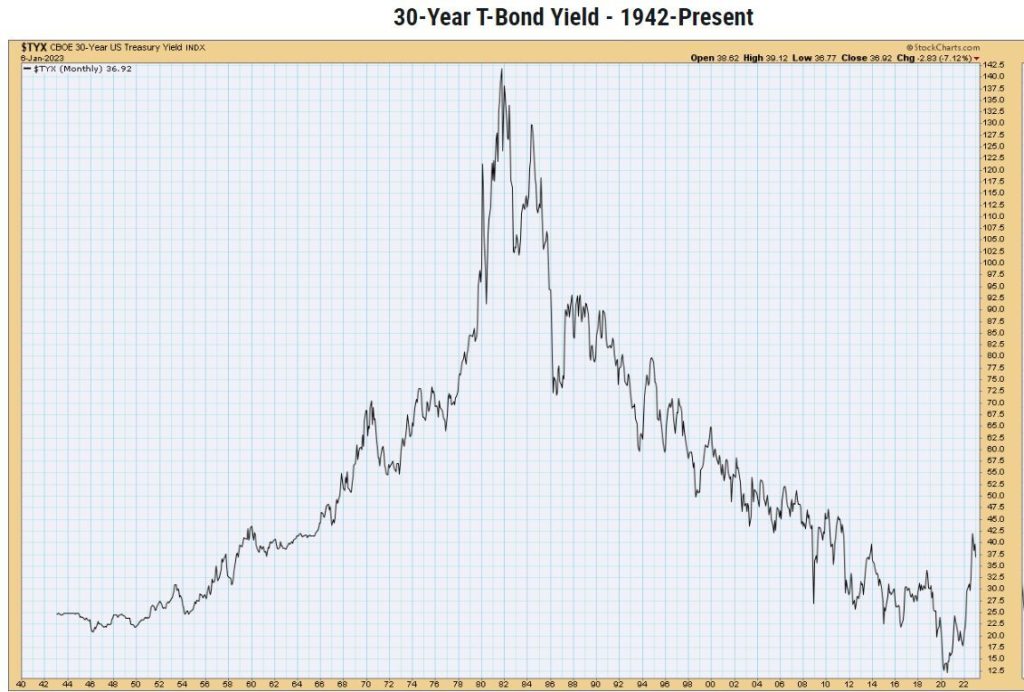

The reason was that after the Great Inflation of the 1970’s and early 1980’s, we had 40 years of monetary easing and falling bond yields – a secular bull market in bonds – interrupted by the occasional cyclical monetary tightening move and increase in bond yields. The graph below shows you the history of bond yields from 1942 to present day.

It is pretty easy to see how far bond yields fell since the early 1980’s. But you might be curious to know why that is important when we are thinking about the stock market. Bonds and stocks are two entirely different investments – bonds represent the debt of an entity and stocks represent the equity of an entity – two different sides of the balance sheet!

The answer has to do with valuation: stocks are valued (at least when markets are rational) upon future cashflows that they are able to earn for their owners (ie, their stockholders). To value those future cashflows, you have to project them into the future then discount them to present day. When you discount them, you have to use an interest rate called (naturally) the discount rate. When you choose that discount rate, you normally choose an interest rate that is relevant to the current economy. The higher the discount applied to those future cashflows, the lower the value of the stock you are analyzing. Conversely, the lower the discount rate, the higher the value of those cashflows and stock prices.

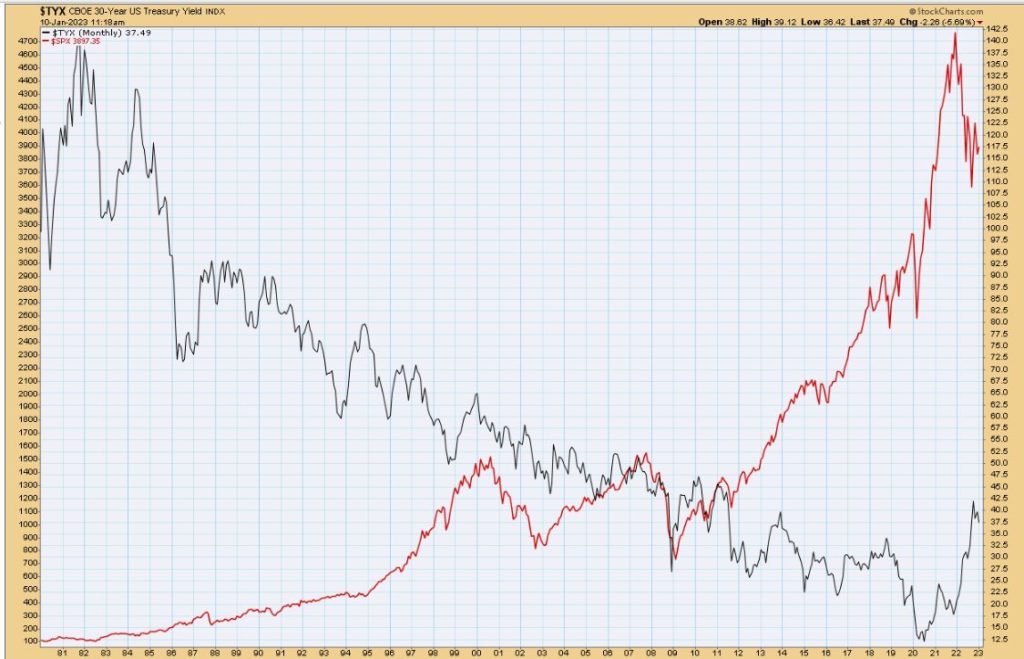

When you look at the above graph and see interest rates falling, you presume that over that period of 40 years, discount rates were also falling so company cashflows were being valued higher. This (along with growing corporate earnings that were also helped along by the monetary stimulus of lower rates) pushed the stock market higher. Below, check out this graph just so you know your presumption was correct!

This graph shows that over this 40 year period while bond yields were falling (black line) stock prices were rising (red line is the S&P 500 Index). You now know the key to determining when to be an index fund buyer and when to be a stock picker. Index funds out-perform most stock pickers during falling bond yields – so the exact opposite is true during rising bond yields (see the far right side of the graph above), index funds fall when yields rise, but stock pickers can position portfolios in the areas of the market that are performing well due to other economic influences in spite of rising bond yields. And that is exactly what happened in 2022 which was to the advantage of our clients.

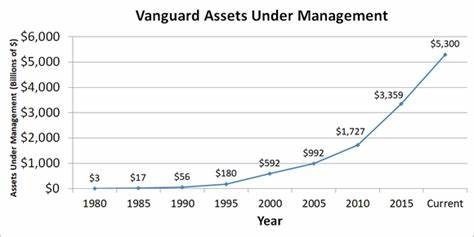

So, you may be asking yourself if index fund investing has really been that prevalent compared to stock picking. Anecdotally, you hear things people make statements like “it’s impossible to beat the market so you might as well save the fees and buy a low cost index fund.” It’s been a great marketing statement by the providers of index funds and they used the secular trend in bond yields to exponentially grow their business (which is providing index funds for people to choose instead of actively managed portfolios). You can see the assets under management of the Vanguard Group (the largest index fund provider) below – they have grown skyhigh as investors jumped on the index fund bandwagon to take advantage of falling bond yields without even knowing it!

Unfortunately for index fund investors, they are in for a painful future if they remain in their current index fund investments thinking that the past will repeat itself and that the low costs on those funds will make a difference. Here’s a hint: they are wrong – bond yields will not and cannot stay low forever. The current bout of inflation we see will remain for a lot longer than Wall Street and CNBC are telling you.

Why do I say this?

The root of inflation (in addition to the spendthrift ways of our government) is energy prices (that is stage one). Energy prices impact EVERYTHING and the demand/supply imbalance of, on average 3 million barrels per day, will keep a floor under energy prices until something changes. Additionally, now that inflation has taken root, stage two of an inflationary economy kicks in and that is wage inflation. Wage inflation is a permanent price increase – at least energy price inflation can abate if the demand/supply imbalance hits equilibrium (you saw an peak at this as the Chinese economy shut down for Covid and the gas prices you paid at the pump went from $5 to $3 (in big round numbers), but that is over and the imbalance is expected to return if not increase (maybe a topic for a future blog post?).

In the graph below, you can see the progression higher of US Average Hourly Wages over the course of 2022 as the inflation we have all felt ratched higher.

Inflation is not the only reason I say bond yields will be elevated for the foreseeable future – the our national debt levels are now at the point where very soon all taxes collected by the government (just shy of $5 Trillion in 2022) will go to servicing out debt and no money will be left over to pay for the rest of government. No one in their right mind will ever again buy a treasury bond with a 0.50% yield – the risk is too great. Either the government will have to pay higher and higher rates on treasury bonds to attract buyers or they will have to manipulate treasury interest rates lower while the rest of the bond market is paying market rates – and then the only buyer will be the Federal Reserve who is in charge of keeping rates high! Quite the problem, and one that we (and the rest of the developed world who have followed the same failed monetary policy) will have on our plate for generations to come – unless a new Bretton Woods (circa 1944) happens and everyone defaults at the same time – something too ugly to contemplate in this blog post but maybe in a future one if I am feeling dystopian.

SUMMARY

In Part 1 of this series, we discussed our Model Portfolios’ significant outperformance compared to the S&P 500 Index. Today, we discussed that the outperformance was due to it being a stock pickers market compared to a market where “a rising tide lifts all boats” and index funds were the easy way to participate in the market. We also discussed why I believe the index fund investing strategy is a train that has left the station.

The only way to consistently show success in coming years is to select the right stocks in the right parts of the market for the economic influences not impacted by rising bond yields (which will be followed by bond yields sustained at an elevated level). In Part 3 of this series, we will discuss s some of those economic influences and the parts of the market that should outperform in spite of the current trajectory of bond yields. Part 4 of this series will talk about alternatives to an index fund strategy that will allow investors to perform much better than the indices and the funds tied to them.

If you have questions about this or would like to discuss having BankChampaign help you with your investments, please contact me at the bank.

Thanks for reading!

–Mark