he Role of Leverage in Stock Market Tops: A Historical and Comparative Analysis

Introduction

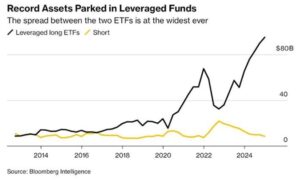

Leverage is the financial fuel that can propel markets to unprecedented highs—but it can also lead to volatility and market corrections. Right now, we are seeing a surge in leveraged funds, with retail investors piling in despite Wall Street’s growing concerns over AI, crypto, and market fragility. As Bloomberg reports, leveraged funds have reached nearly $100 billion, with fewer bets against the market than ever before. The following chart from Bloomberg illustrates this and was the catalyst for this post.

But how does this compare to past stock market peaks? Are we heading toward another crisis fueled by excessive leverage, or is this just a new phase of market expansion? Let’s examine historical leverage trends, compare them to today’s market, and explore what happens when leverage-driven euphoria turns into market pullbacks.

Understanding Leverage in the Stock Market

Leverage is a financial strategy that allows investors to borrow money to increase their exposure to an asset, with the goal of amplifying returns. While leverage can significantly enhance profits when used correctly, it also magnifies losses. However, leverage is not inherently dangerous—it is a necessary tool that enables innovation, market expansion, and economic growth when used strategically.

How Leverage Works in Investing

Leverage enables an investor to control a larger position in a stock or asset than they could with their own capital alone. This is done by borrowing funds from a broker, bank, or financial institution.

For example, if an investor has $10,000 and uses a leverage ratio of 2:1, they can control a $20,000 position. If the stock price rises by 10%, the investor’s total position increases to $22,000, yielding a $2,000 profit—double what they would have earned without leverage. However, if the stock declines by 10%, their losses are also doubled, reducing their investment to $18,000.

Types of Leverage in Investing

There are different ways investors can use leverage in financial markets, including:

- Margin Trading – Borrowing money from a brokerage firm to buy stocks or other securities. Investors pay interest on the borrowed funds and must maintain a minimum account balance.

- Leveraged ETFs – Exchange-traded funds that use derivatives and debt to amplify returns, often aiming for 2x or 3x the daily performance of an index.

- Options and Futures Contracts – These derivatives allow investors to control large positions with relatively small amounts of capital. Options trading, in particular, can provide significant leverage.

- Corporate Leverage – Companies also use leverage to finance growth by issuing bonds or taking on debt rather than using equity.

The Risks of Leverage

While leverage can enhance gains, it also increases the risk of losing more than the initial investment. Some key risks include:

- Magnified Losses – Just as leverage increases potential profits, it also amplifies losses. A small drop in stock price can result in significant losses for leveraged investors.

- Margin Calls – If an investor’s losses exceed a certain threshold, brokers may demand additional funds to cover the shortfall, forcing investors to sell assets at a loss.

- Market Volatility – Leverage makes investments more sensitive to market fluctuations. High volatility can quickly erode leveraged positions.

Historical Instances of Leverage That Didn’t Work Out

Leverage has played a crucial role in some of the biggest financial booms and busts in history. When market conditions are favorable, investors often take on excessive leverage to maximize returns. However, as history has shown, when markets turn, high leverage can trigger rapid collapses, wiping out fortunes and destabilizing the financial system.

Below, we examine three major market events where excessive leverage contributed to a financial crisis: the Dot-Com Bubble (1999-2000), the 2008 Financial Crisis, and the COVID-19 Rally (2020-2021).

The Dot-Com Bubble (1999-2000): A Leverage-Fueled Tech Mania

The late 1990s saw an explosion of interest in internet-based companies, as investors believed the digital revolution would fundamentally change the economy. As a result, speculation drove stock prices to extreme levels, with many companies trading at valuations that far exceeded their actual earnings potential.

How Leverage Fueled the Dot-Com Boom

- Margin Debt Surged – Investors borrowed heavily to buy tech stocks, believing prices would only go up. By early 2000, margin debt had reached record highs, amplifying the gains (and future losses) of traders.

- Speculative IPOs – Many startups with little or no revenue were going public, attracting investors willing to take on margin debt to get in early.

- “Irrational Exuberance” – A term coined by then-Federal Reserve Chairman Alan Greenspan, describing the overconfidence that led investors to ignore risk and pile into overvalued tech stocks.

The Crash and Its Consequences

By early 2000, cracks began to form as investors started questioning the sustainability of tech stock valuations. When the selling started, it triggered a domino effect:

- Nasdaq lost nearly 80% of its value between 2000 and 2002

- Overleveraged traders faced margin calls, forcing them to sell at a loss, accelerating the decline

- Billions of dollars in wealth were wiped out, leading to a multi-year economic slowdown

The lesson from the Dot-Com Bubble? Leverage magnifies both gains and losses, and when speculation reaches extreme levels, market corrections can be devastating.

The 2008 Financial Crisis: A Debt-Driven Disaster

The 2008 financial crisis was one of the worst global economic downturns in history, primarily driven by excessive leverage in the housing market and financial sector. Unlike the Dot-Com Bubble, which was centered around stock market speculation, the 2008 crisis was fueled by leverage in mortgage-backed securities (MBS) and complex financial derivatives.

How Leverage Created a Financial Time Bomb

- Banks and Investment Firms Were Overleveraged – Large financial institutions, including Lehman Brothers, borrowed heavily (30:1 or even 40:1 leverage ratios) to invest in mortgage-backed securities.

- Subprime Mortgages Were Packaged and Sold – Lenders issued risky subprime loans to borrowers with poor credit, assuming that rising housing prices would prevent defaults. These loans were bundled into securities and sold to investors worldwide.

- Derivatives and Credit Default Swaps (CDS) Increased Risk – Wall Street firms used derivatives to magnify exposure, increasing systemic risk.

The Crash and Its Consequences

The housing market peaked in 2006, and by 2007, defaults on subprime mortgages started to rise. As mortgage-backed securities lost value, banks and investment firms with excessive leverage collapsed. The worst came in 2008:

- Lehman Brothers filed for bankruptcy, triggering panic in financial markets.

- Stock markets worldwide crashed, with the S&P 500 losing nearly 50% of its value.

- Millions lost their homes, jobs, and savings as the crisis led to a global recession.

The 2008 financial crisis underscored how excessive leverage in the banking system can create systemic risks, leading to widespread economic collapse.

The COVID-19 Rally (2020-2021): The Rise and Fall of Speculative Frenzy

The stock market crash of March 2020, triggered by the COVID-19 pandemic, was followed by one of the fastest recoveries in history. Massive government stimulus, ultra-low interest rates, and retail investor enthusiasm fueled an unprecedented bull market, with leverage playing a key role.

How Leverage Fueled the 2020-2021 Market Surge

- Record Stimulus and Cheap Money – The U.S. government injected trillions into the economy, while the Federal Reserve cut interest rates to near-zero, making borrowing incredibly cheap.

- Retail Investors Piled into Stocks and Crypto – Platforms like Robinhood made it easier for small investors to trade with leverage, leading to a surge in speculative bets.

- Meme Stock Mania – Heavily shorted stocks like GameStop (GME) and AMC skyrocketed as retail traders used leverage to drive up prices.

The Crash and Its Consequences

By late 2021, inflation concerns and rising interest rates signaled an end to the easy money era. As leverage unwound:

- Tech stocks and speculative assets collapsed, wiping out massive gains.

- Bitcoin and other cryptocurrencies crashed, with Bitcoin dropping from $69,000 to under $20,000.

- Retail traders faced margin calls, forcing many to exit positions at a loss.

While the COVID-19 Rally was shorter-lived than previous bubbles, it highlighted how leverage, combined with easy access to trading, can lead to extreme market swings.

Current Market Trends and Leverage Usage

In today’s financial markets, leverage is at near-record levels, driven by a mix of retail investor enthusiasm, speculation in AI and cryptocurrency, and increased participation in leveraged funds. While institutional investors have traditionally been the primary users of leverage, retail traders now play an outsized role in fueling market movements.

Let’s break down the major trends shaping leverage usage today by first examining the negatives/risks (don’t worry, we will discuss the positives after we examine the risks):

The Rise of Retail Investors and Leveraged Funds

Retail investors have gained unprecedented access to leveraged trading, thanks to zero-commission platforms and mobile apps that simplify margin trading. Unlike institutional investors, who often use leverage strategically with risk management tools, many retail traders are aggressively speculating with borrowed money—often with little understanding of the risks involved.

How Retail Investors Are Driving Leverage Growth

- Robinhood and Other Trading Apps – Platforms like Robinhood, Webull, and eToro have made it incredibly easy for retail traders to borrow money (margin trading) and trade complex derivatives with little experience.

- Leveraged ETFs and Options – ETFs that provide 2x or 3x market exposure have surged in popularity. These funds allow traders to amplify gains (and losses) with minimal capital. For example, the ProShares UltraPro QQQ (TQQQ), which delivers 3x the Nasdaq 100’s performance, is one of the most actively traded leveraged funds.

- Social Media-Driven Speculation – Online communities on platforms like Reddit (r/wallstreetbets) and Twitter (X) frequently promote high-risk, leveraged trades, leading to herd mentality-driven market frenzies.

Impact on the Market

The rise in retail leverage has contributed to:

- Increased volatility – Leveraged retail trading often exaggerates price swings, especially in momentum stocks.

- Short squeezes and gamma squeezes – Stocks like GameStop (GME) and AMC skyrocketed in 2021 as retail traders used margin to drive up prices and force institutional short sellers to cover their positions.

- Rapid boom-and-bust cycles – Leveraged trading accelerates both rallies and crashes, as margin calls force overextended traders to liquidate their positions quickly.

While leveraged funds offer the potential for massive profits, they also pose systemic risks, as sharp market declines can trigger forced selling, leading to downward spirals.

AI, Crypto, and Speculative Assets Fueling Leverage Appetite

In 2023 and 2024, two of the biggest drivers of market speculation have been Artificial Intelligence (AI) stocks and cryptocurrencies. Both asset classes have attracted huge amounts of leveraged investment, as traders look for the next exponential growth opportunity.

AI Stocks: The New Tech Bubble?

The rise of AI-driven investing has sparked a massive rally in companies tied to artificial intelligence, with some traders taking on significant leverage to maximize exposure.

- Nvidia (NVDA) as the Poster Child – Nvidia, the dominant supplier of AI chips, has seen its stock price surge by hundreds of percent over the past two years. As hedge funds and retail traders poured into the stock, margin debt skyrocketed, mirroring past tech bubbles.

- AI Penny Stocks and Speculative Plays – Small-cap companies with minimal AI exposure have seen their stock prices soar simply by mentioning “AI” in press releases, reminiscent of the Dot-Com Bubble in the late 1990s.

- Tech Leverage Spikes – The Nasdaq has experienced an influx of leveraged call option buying, further driving up AI-related stocks.

Crypto: The Leverage-Fueled Rollercoaster

Cryptocurrency has been one of the most leverage-heavy markets in recent years. Despite its volatility, traders continue to use extreme leverage in Bitcoin, Ethereum, and altcoins, betting on rapid price movements.

- Crypto Leverage Exchanges – Platforms like Binance, Bybit, and BitMEX allow traders to take 100x leverage on crypto derivatives, meaning a 1% move could double or wipe out an entire position.

- Liquidations and Market Crashes – The 2021 crypto bull run was heavily fueled by leverage, and when the market turned, billions of dollars in liquidations caused prices to plummet. Similar events occurred in 2022 with the collapse of FTX, one of the largest crypto exchanges.

- Bitcoin ETFs and Institutional Involvement – The recent approval of Bitcoin spot ETFs has brought more institutional money into the market, but leveraged trading in crypto futures remains dominated by retail traders.

The Risk of AI and Crypto Leverage

The combination of hype-driven narratives and leverage makes AI and crypto two of the most dangerous speculative arenas. While they present real technological advancements, excessive leverage means sharp corrections can wipe out gains rapidly, just as we saw in past market bubbles.

Institutional Leverage vs. Retail Speculation

While retail traders have taken center stage in leveraged speculation, institutional investors still control the majority of leveraged assets—but they use them very differently.

Institutional Leverage: A More Strategic Approach

- Hedge Funds and Quant Trading – Large hedge funds use leverage in quantitative strategies and arbitrage, often hedging their risks with other positions.

- Private Equity and Corporate Leverage – Private equity firms use leveraged buyouts (LBOs) to acquire companies, financing deals primarily with debt.

- Investment Banks and Derivatives – Wall Street firms use complex financial instruments, such as credit derivatives and structured products, to magnify returns on trades.

While institutions use leverage to optimize returns, they generally have risk management protocols in place to prevent extreme losses.

Retail Speculation: The Wild West

Retail traders, on the other hand, often use leverage without risk controls, leading to:

- Reckless margin trading – Many traders max out margin accounts without fully understanding the risks.

- Leveraged options trading – The explosion of weekly and zero-day-to-expiry (0DTE) options has created extreme volatility, with retail traders often chasing short-term moves.

- Herd mentality speculation – Retail traders tend to follow social media trends, leading to sudden bubbles in specific stocks or assets.

Warning Signs: What Can Happen If Leverage Reaches Extreme Levels?

Leverage can be a powerful tool in a bull market, helping investors amplify gains. However, when leverage becomes excessive, it also increases the risk of market instability, volatility, and large-scale selloffs. History has shown that at market peaks, high leverage is often followed by a painful correction as investors face margin calls, liquidity shortages, and a shift in market sentiment.

Below, we examine three major warning signs that indicate leverage may be reaching dangerous levels and what that could mean for the market.

Rising Market Instability and Volatility Spikes

One of the first signs that leverage is reaching extreme levels is an increase in market volatility. While markets generally experience fluctuations, a sudden rise in unpredictable price swings often signals that leverage is playing a larger-than-usual role in price movements.

Single-Stock Fragility at Record Highs

Bloomberg recently reported that single-stock fragility has reached record levels. But what does this mean?

- Single-stock fragility refers to the tendency of individual stocks to experience sharp, sudden price swings—even in the absence of major news.

- This phenomenon suggests that stocks are being driven by speculative, high-leverage trading, rather than fundamental factors.

- When highly leveraged positions unwind, even small shifts in sentiment can trigger outsized moves, leading to a cascade of volatility.

Volatility Index (VIX) Spikes and Market Jitters

- The Cboe Volatility Index (VIX), often called the “fear gauge,” typically spikes when leverage starts to unwind.

- A sudden increase in VIX levels often signals that traders are rushing to hedge against potential downside risks, often driven by concerns over excessive leverage.

Case Study: The Flash Crash of 2010

A famous example of leverage-driven volatility was the Flash Crash of May 6, 2010, when the Dow Jones Industrial Average plunged nearly 1,000 points in minutes, only to recover shortly after. Analysts later determined that high-frequency traders and leveraged derivative positions played a key role in amplifying the crash.

Liquidity Risks and Margin Calls Triggering Selloffs

When leverage reaches extreme levels, the market becomes vulnerable to forced selling and liquidity crises. Here’s how it happens:

- Margin Calls and Forced Liquidations

- When investors use leverage, they must maintain a minimum account balance (known as the margin requirement).

- If the value of their leveraged investments falls below a certain level, brokers issue margin calls, requiring traders to deposit additional funds.

- If traders fail to meet margin calls, brokers force-sell their assets to cover the debt, creating downward pressure on stock prices.

Example: The Archegos Capital Collapse (2021)

- Archegos Capital, a highly leveraged hedge fund, collapsed in 2021 when it failed to meet margin calls.

- The fund had used massive leverage to build concentrated positions in stocks like ViacomCBS and Discovery.

- When these stocks fell, banks were forced to liquidate billions in holdings, leading to a rapid stock price collapse and billions in losses for financial institutions.

- Market Liquidity Dries Up

- When leveraged traders are forced to sell en masse, liquidity can evaporate, leading to sharp, unpredictable price declines.

- Institutional traders may also pull back, further reducing market depth and exacerbating price swings.

Example: The 2008 Financial Crisis and Liquidity Freeze

During the 2008 crisis, banks and hedge funds were so highly leveraged that they couldn’t cover their debts. As a result:

- Liquidity dried up, making it difficult for firms to sell assets without causing further price declines.

- The interbank lending market froze, leading to the collapse of Lehman Brothers and a full-scale financial crisis.

- The Domino Effect of Leverage Unwinding

- When one sector of the market deleverages, it often spills over into other sectors.

- Leverage-fueled rallies can reverse quickly, leading to panic selling and widespread fear.

BTFD Losing Effectiveness – A Shift in Market Dynamics?

For years, the “Buy The Dip” (BTFD) strategy has been a winning play for traders. Whenever stocks dipped, investors rushed in to buy, confident that markets would rebound quickly. However, recent trends suggest that BTFD may not work as well going forward, for several reasons.

- The Fed is No Longer Providing Unlimited Liquidity

- In past market cycles, the Federal Reserve provided ample liquidity through low interest rates and quantitative easing (QE).

- However, with inflation concerns rising, the Fed has shifted to tighter monetary policy, making cheap leverage less available.

- This means that the easy money that fueled past rallies may not be there next time markets dip.

- Changing Market Psychology

- BTFD worked in the 2020-2021 bull run because investors believed the Fed would always step in to support markets.

- However, if investors start to doubt that central banks will intervene, they may hesitate to buy dips, leading to prolonged downturns.

Example: Japan’s “Lost Decades” and the Failure of BTFD

- In the 1990s, Japan experienced a massive stock market and real estate bubble, fueled by leverage.

- When the bubble burst, the market never fully recovered, and BTFD stopped working as investors lost confidence.

- This serves as a cautionary tale that BTFD is not a guaranteed strategy—it works until it doesn’t.

- Greater Market Fragmentation and AI Trading

- Algorithmic trading now dominates markets, meaning that price moves are often driven by bots rather than retail sentiment.

- Many hedge funds use machine learning models to detect and exploit BTFD traders, making the strategy less effective.

- Increased single-stock fragility means that previously stable stocks can experience massive drops, scaring away dip-buyers.

Comparing Today’s Market to Past Leverage Crises

The current stock market environment bears striking similarities to past leverage-fueled crises, particularly the Dot-Com Bubble (1999-2000) and the 2008 Financial Crisis. However, key differences—such as Federal Reserve policies, the role of artificial intelligence (AI), and algorithmic trading—suggest that the next market correction may not play out exactly as previous ones did.

Let’s explore both the similarities and differences between today’s market and past leverage-driven crises.

Similarities with the Dot-Com Bubble and the 2008 Financial Crisis

Despite advancements in market structure and regulatory oversight, many of the warning signs that preceded past crashes are present in today’s market. These include high retail investor participation, extreme leverage usage, and speculation-driven surges in certain asset classes.

- High Retail Participation: The “Meme Stock” Phenomenon vs. Dot-Com Speculation

- In the late 1990s, retail investors flooded into tech stocks, betting on the future of the internet. Many of these investors had little experience and were driven by media hype, online forums, and stock tips from friends.

- In today’s market, retail investors have become a dominant force, spurred by easy access to trading platforms like Robinhood, commission-free trading, and social media-fueled investing trends (e.g., Reddit’s r/wallstreetbets).

- Meme stock mania (GameStop, AMC, and Bed Bath & Beyond) in 2021 mirrored the irrational exuberance of the Dot-Com era.

Key Parallel:

In both cases, small retail traders drove up stock prices to unsustainable levels, often using margin and options to amplify their bets—a classic sign of speculative excess.

- Extreme Leverage Levels: A Recipe for Volatility

Leverage usage today is reminiscent of the high-margin debt levels seen before past crashes:

- Dot-Com Bubble (1999-2000):

- Margin debt reached record highs as investors borrowed aggressively to buy tech stocks.

- When the market turned, margin calls forced investors to sell, accelerating the crash.

- 2008 Financial Crisis:

- Wall Street banks and hedge funds were heavily overleveraged, particularly in mortgage-backed securities (MBS) and credit default swaps (CDS).

- When housing prices collapsed, margin calls and liquidity shortages led to financial institution failures (e.g., Lehman Brothers).

- Today’s Market (2024):

- Retail and institutional leverage is at near-record highs, with Bloomberg reporting leveraged ETF exposure surpassing $100 billion.

- Hedge funds and retail traders alike are heavily using options and derivatives, making the market more fragile.

- Rising leverage has led to extreme price swings in AI stocks, crypto, and speculative assets.

Key Parallel:

In each case, leverage amplified price gains on the way up—but also increased downside risk when sentiment shifted.

- Speculation-Driven Market Surges: AI & Crypto vs. Tech & Housing

Each leverage-fueled bubble had a specific sector that attracted massive speculation:

- Dot-Com Era (1999-2000): Investors piled into internet stocks, often ignoring fundamentals and buying anything related to “dot-com.”

- 2008 Crisis: The housing market was the speculative hotbed, with banks and investors overleveraging into mortgage-backed securities.

- Today (2024):

- AI Stocks: The surge in stocks like Nvidia, Microsoft, and AI-related startups resembles the Dot-Com hype.

- Cryptocurrency: Bitcoin, Ethereum, and speculative altcoins have experienced multiple boom-and-bust cycles fueled by leverage.

- Leveraged ETFs & Meme Stocks: New financial instruments are allowing traders to speculate at unprecedented levels.

Key Parallel:

In all three periods, investors chased a “revolutionary” trend, believing it would justify extreme valuations—only for reality to eventually set in.

Differences Due to Federal Reserve Policies and Technology

Despite these similarities, today’s market differs in significant ways due to Federal Reserve interventions, AI-driven trading, and structural changes in market behavior.

- More Federal Reserve Interventions: A Safety Net for Markets?

One of the biggest differences between today and past leverage-fueled crashes is the role of the Federal Reserve (Fed).

- Dot-Com & 2008 Crashes:

- The Fed did not actively intervene to stop the Dot-Com crash and allowed major banks to fail in 2008 (e.g., Lehman Brothers) before launching massive stimulus efforts.

- COVID-19 Rally (2020-2021) & Today:

- The Fed has been much quicker to step in with stimulus, cutting rates and providing liquidity.

- The market now operates under a “Fed Put” mentality, where investors expect the Fed to intervene whenever markets drop too much.

- This has kept leverage levels high, as traders believe the Fed will always bail them out—a dangerous mindset that could lead to bigger bubbles.

Key Difference:

Unlike past crashes, investors today assume the Fed will always intervene to prevent a total collapse, potentially delaying the market reckoning.

- AI and Algorithmic Trading: A Market Controlled by Machines

Another major difference between today’s market and past crises is the rise of algorithmic trading and artificial intelligence in financial markets.

- In 1999-2000 and 2008, the market was dominated by human traders and fund managers, who made decisions based on traditional analysis.

- Today, 70-80% of stock market volume is driven by algorithmic trading, with AI models detecting trends, momentum, and arbitrage opportunities at lightning speed.

- High-Frequency Trading (HFT) firms now control a large portion of daily trading volume, reacting to market movements in microseconds.

Implications of AI & Algorithmic Trading on Market Leverage

- Increased Volatility: AI and algorithmic models often exacerbate market swings by executing rapid buy and sell orders in response to price movements.

- Faster Crash Cycles: In past crises, market crashes took months to play out. Today, AI-driven sell programs could trigger collapses in hours or even minutes.

- Difficulty in Predicting Market Moves: Traditional market analysis is less effective today, as machine-driven models respond to complex datasets in unpredictable ways.

Key Difference:

Today’s market is far more influenced by AI and algorithmic trading, making it more unpredictable and potentially more fragile than past cycles.

What Could Happen Next? Scenarios for the Market

The current market environment is heavily influenced by high leverage, speculation, and Federal Reserve policies. While some analysts predict a gradual unwinding of leverage (soft landing) or a sharp correction (hard landing), there is also the possibility that the market continues to grow despite high leverage levels, driven by liquidity and investor sentiment.

Let’s explore the three most likely scenarios for the market going forward:

- A Soft Landing: Gradual Leverage Unwinding

A soft landing would mean that leverage levels slowly decline without triggering a full-blown financial crisis.

Key Conditions for a Soft Landing:

- Federal Reserve successfully manages liquidity by adjusting interest rates gradually, preventing panic in leveraged markets.

- Corporate earnings remain strong, allowing stock prices to justify high valuations.

- Retail and institutional investors reduce margin usage voluntarily, decreasing the risk of margin calls.

- Volatility remains contained, preventing large-scale liquidations and forced selling.

Possible Outcomes:

- Stock prices stabilize or experience moderate corrections, rather than sharp declines.

- Investors adjust leverage levels in response to changing monetary policy.

- New leadership emerges in markets as capital shifts away from overleveraged speculative assets into more fundamentally sound investments.

This scenario is ideal for long-term investors, as it avoids a market crash while allowing speculative excesses to cool off gradually.

- A Harsh Correction: Leverage-Driven Market Crash

If leverage unwinds too quickly, it could trigger a major market correction, similar to the 2008 financial crisis or the Dot-Com Bust of 2000.

Key Triggers for a Harsh Correction:

- A sudden macroeconomic shock, such as rising inflation, geopolitical events, or an unexpected Fed rate hike, causes panic in leveraged markets.

- Margin calls force investors to sell assets, creating a self-reinforcing cycle of declining prices and further liquidations.

- Liquidity dries up, similar to past financial crises, making it difficult for leveraged traders to exit positions without incurring large losses.

- Investor sentiment shifts rapidly, leading to panic selling and a sharp market downturn.

Possible Outcomes:

- Stock prices collapse, particularly in high-flying tech stocks, AI stocks, and speculative assets that have benefited the most from leverage.

- Hedge funds and retail traders with excessive margin exposure face massive losses.

- Federal Reserve may be forced to intervene, but policy responses may be too late to prevent a severe downturn.

This scenario would be the most painful for leveraged investors and could lead to a multi-year bear market if confidence in the system is shaken.

And Now Some Positives…

Since we’ve talked a whole lot about the risks of an overleveraged market, there is a very viable third scenario to look at:

- Status Quo: High Leverage and a Growing Stock Market

There is also the possibility that the market continues rising despite record leverage levels, driven by liquidity, optimism, and investor confidence.

Key Factors Supporting This Scenario:

- Federal Reserve continues providing liquidity – Even if rate hikes slow, the Fed may not aggressively tighten financial conditions, allowing leverage to remain high.

- Retail and institutional investors keep borrowing, believing in the Fed’s implicit support for markets (the “Fed Put”).

- Strong corporate earnings and AI-driven optimism sustain high valuations, preventing a major correction.

- Inflation remains under control, reducing pressure on the Fed to raise rates aggressively.

Possible Outcomes:

- Stock markets continue climbing as investors double down on risk assets.

- Leverage remains at record highs, but as long as asset prices rise, margin calls and forced liquidations are avoided.

- Tech and AI stocks lead the market higher, creating a cycle of continued speculation.

- Retail traders remain dominant, using platforms like Robinhood and Webull to fuel the momentum rally.

This scenario could resemble the late stages of the Dot-Com Bubble, where markets kept rising for years despite clear warning signs—until they didn’t.

Yet, this time we could simply see the market trade sideways as it works off the excesses and investors loose interest in being over-leveraged when they are not seeing an immediate payoff.

Historical Examples of Sideways Markets Instead of Corrections:

- The 2004-2006 Market Consolidation – After the rapid recovery from the Dot-Com Bust and the 2001 recession, the stock market entered a multi-year period of consolidation where major indices like the S&P 500 and Dow Jones traded within a relatively tight range. Rather than correcting sharply, the market absorbed excess valuations through slower growth before resuming an uptrend.

- The Post-1987 Crash Recovery (1988-1991) – Following the Black Monday crash in October 1987, the stock market did not experience a prolonged bear market. Instead, it gradually stabilized and traded sideways for several years while earnings growth caught up with valuations, leading to a strong bull market in the mid-1990s.

- The 2015-2016 Market Stagnation – After several years of strong stock market gains driven by Federal Reserve stimulus, the S&P 500 experienced an extended period of sideways trading between 2015 and 2016. Despite fears of a correction, strong corporate earnings and monetary policy support helped the market digest its overvaluation without a major downturn.

- The 2018-2019 Fed-Induced Slowdown – After the sharp rally in 2017, the stock market faced volatility in 2018 due to concerns over Fed rate hikes. However, instead of a prolonged bear market, stocks traded sideways for much of 2018 before resuming their uptrend in 2019 as interest rates stabilized and corporate earnings continued to grow.

- Japan’s Post-2013 Market Stabilization – Following aggressive monetary easing policies by the Bank of Japan, the Nikkei 225 surged in 2013. While valuations appeared stretched, the index did not experience a crash but rather traded sideways through 2014 and 2015 as the economy adjusted to structural reforms and monetary policy shifts.

Implications for Today’s Market:

If history is any indication, markets do not always correct sharply after periods of high speculation and leverage. Instead, they can stabilize through extended periods of range-bound trading, allowing earnings growth to catch up with valuations. This scenario would benefit investors who maintain positions in fundamentally strong growth sectors like AI, cloud computing, and semiconductors, while excess speculation is gradually unwound from weaker parts of the market.

Rather than viewing a lack of immediate upside as a negative, long-term investors should see a sideways market as an opportunity to accumulate high-quality assets at reasonable valuations before the next sustained bull run begins.

Earnings Growth Prospects: Why Investing in AI, Crypto, and High-Tech Sectors Might Be Worth the Risk

Despite concerns about high leverage and speculative excess, the long-term earnings potential in key sectors—particularly Artificial Intelligence (AI), cryptocurrency, and high-tech industries—remains strong. While volatility and market corrections are inevitable, these sectors continue to attract investment due to their disruptive potential, innovation, and rapid revenue growth.

In this section, we compare the earnings growth potential of AI, crypto, and high-tech companies against the broader market and examine why continuing to invest in these areas may still be worth the risk.

1. AI: The Next Trillion-Dollar Industry?

Why AI Stocks Continue to Attract Capital

Artificial intelligence has emerged as one of the fastest-growing sectors in technology, with massive earnings growth potential across multiple industries. Companies developing AI models, semiconductor chips, and enterprise AI solutions are seeing explosive revenue increases, justifying continued investment.

- AI-powered productivity gains – Businesses are integrating AI to automate tasks, improve efficiency, and drive cost reductions. This increases demand for AI software and hardware.

- Enterprise AI adoption is accelerating – Corporations worldwide are investing heavily in AI-driven solutions for cloud computing, cybersecurity, and automation.

- Massive investments in AI infrastructure – Companies like Nvidia (NVDA), Microsoft (MSFT), and Alphabet (GOOGL) are pouring billions into AI development, with expectations of high-margin earnings growth over the next decade.

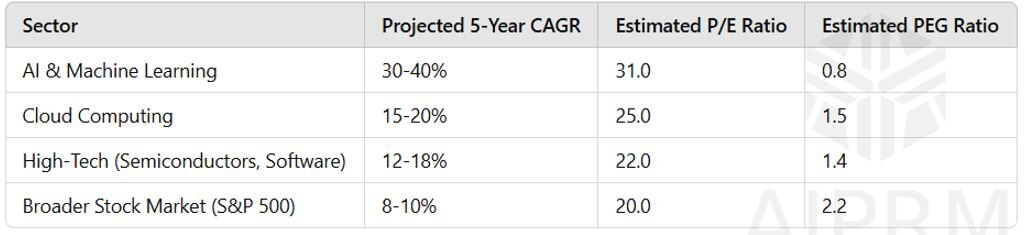

AI Earnings Growth Outlook vs. Broader Market

Key Takeaway:

- AI & Machine Learning: Companies in this sector, such as Nvidia, have an estimated P/E ratio of 31.0 and a projected earnings growth rate of approximately 40%, resulting in a PEG ratio of 0.8.

- Cloud Computing: With an estimated P/E ratio of 25.0 and projected growth of 15-20%, the PEG ratio stands at approximately 1.5.

- High-Tech (Semiconductors, Software): This sector has an estimated P/E ratio of 22.0 and projected growth of 12-18%, leading to a PEG ratio of around 1.4.

- Broader Stock Market (S&P 500): The overall market shows an estimated P/E ratio of 20.0 with projected growth of 8-10%, resulting in a PEG ratio of approximately 2.2.

These figures suggest that, despite higher P/E ratios, sectors like AI & Machine Learning may offer more attractive valuations relative to their growth prospects, as indicated by their lower PEG ratios.

Please note that these estimates are based on available data as of February 2025 and are subject to change with market fluctuations and new financial reports.

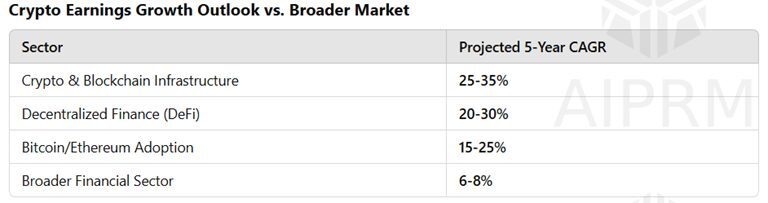

2. Cryptocurrency: A New Financial Paradigm?

Why Crypto Investment Still Makes Sense

Despite extreme volatility and regulatory uncertainty, crypto remains a high-growth asset class, particularly as blockchain technology expands beyond speculative trading into real-world applications.

- Bitcoin and Ethereum institutional adoption – Major financial firms are increasingly incorporating Bitcoin (BTC) and Ethereum (ETH) into investment portfolios, signaling long-term confidence.

- Growing demand for decentralized finance (DeFi) – Decentralized lending, staking, and blockchain-based financial services are disrupting traditional banking, creating new revenue streams.

- Crypto ETFs and mainstream acceptance – The introduction of Bitcoin spot ETFs has attracted institutional investors, fueling higher demand and liquidity.

Key Takeaway:

While crypto prices are volatile, its growth potential in finance, payments, and decentralized applications makes it a high-risk, high-reward investment compared to traditional financial markets.

Although we are not allowed to directly own crypto for clients due to government regulations, we can and do own common stocks that provide services to the crypto industry, companies like Coinbase and Robinhood. I anticipate that those regulations will change over time but currently we follow the law as it stands.

3. High-Tech & Semiconductors: The Backbone of Future Innovation

Why Tech Stocks Still Offer Strong Earnings Potential

Even with concerns about market overvaluation, high-tech industries—especially semiconductors, cloud computing, and cybersecurity—continue to grow at a rapid pace.

- Chip demand is soaring – Companies like Nvidia, AMD, and Taiwan Semiconductor Manufacturing Company (TSMC) are seeing record sales as AI, 5G, and automation drive semiconductor demand.

- Cybersecurity remains a critical need – As cyber threats rise, companies and governments are prioritizing cybersecurity investments, driving revenue growth for firms like Palo Alto Networks (PANW) and CrowdStrike (CRWD).

- Cloud computing expansion – Amazon Web Services (AWS), Microsoft Azure, and Google Cloud continue to dominate, with double-digit annual revenue growth expected.

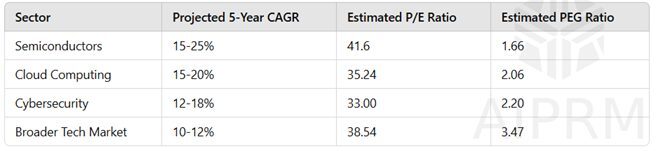

High-Tech Earnings Growth Outlook vs. Broader Market

Key Takeaway:

- Semiconductors: The semiconductor industry is trading above its 3-year average P/E ratio of 41.6, with analysts expecting annual earnings growth of 24.3%. This results in an estimated PEG ratio of approximately 1.66.

- Cloud Computing: Companies in the cloud computing sector, such as Microsoft, have an estimated P/E ratio of 35.24. With projected earnings growth of 15-20%, the PEG ratio is approximately 2.06.

- Cybersecurity: Cyber Security Cloud, a representative company in the cybersecurity sector, has a P/E ratio of 33.00. With projected earnings growth of 12-18%, the PEG ratio is approximately 2.20.

- Broader Tech Market: The S&P 500 Information Technology Sector has an estimated P/E ratio of 38.54. With projected earnings growth of 10-12%, the PEG ratio is approximately 3.47.

Interpretation:

A lower PEG ratio suggests that a sector may be undervalued relative to its earnings growth prospects, while a higher PEG ratio could indicate overvaluation. In this context, the semiconductor sector appears to offer a more attractive valuation relative to its growth prospects compared to the broader tech market.

Please note that these estimates are based on available data as of February 2025 and are subject to change with market fluctuations and new financial reports.

Balancing Risk vs. Reward: Is Investing in These Sectors Worth It?

Investing in AI, crypto, and high-tech stocks comes with significant risks, but the long-term earnings outlook remains strong. Here’s why investors find it worth the risk:

Reasons to Continue Investing in AI, Crypto, and High-Tech Stocks

✅ Higher earnings growth potential than the broader market

✅ Massive technological advancements fueling demand

✅ Institutional adoption is increasing, reducing long-term volatility

✅ Strong market positioning—AI, crypto, and tech are shaping the future

Risks to Consider

❌ Valuation concerns—some stocks are trading at extreme multiples

❌ Regulatory uncertainty—especially in crypto and AI data privacy

❌ Potential for market corrections and leverage unwinding

Investment Strategies for Managing Risk While Staying Exposed to High-Growth Sectors

While investing in these sectors offers high return potential, it’s essential to manage risk effectively.

- Diversify Within the Sector

- Instead of going all-in on one AI or crypto stock, spread investments across multiple companies to reduce risk.

- Example: Owning both Nvidia (NVDA) and AMD (AMD) to hedge semiconductor exposure.

Important Side Note: I get asked a lot why I like to have so many positions in a portfolio. This is precisely the reason – there can be individual company risk that is not present in other individual companies within a sector – in the 40+ years I have been managing investment portfolios I have seen it time and time again. By owning multiple companies within the same sector you are more effectively managing the risk the client is accepting by investing in equity securities.

- Use a Long-Term Approach

- AI and crypto markets can be volatile in the short term, but long-term trends remain strong.

- Avoid panic selling during market pullbacks—historical data shows long-term tech investors tend to outperform.

- Limit Leverage Exposure

- Given the speculative nature of AI, crypto, and high-tech stocks, using excessive margin or leveraged ETFs increases risk.

- Focus on fundamental growth stocks rather than speculative short-term plays.

Conclusion

Leverage can drive markets higher, but history shows that excessive leverage eventually leads to painful corrections. As we compare today’s market to past peaks, the warning signs are clear: rising instability, speculative frenzies, and a reliance on central bank intervention.

However, while the warning signs are present, the long-term trajectory of AI, crypto, and high-tech remains strong, making temporary pullbacks or consolidation periods an attractive entry point for strategic investors and a must for investment managers to maintain positions even during market volatility.