Protect what you've worked hard for

Fraudsters are always finding new ways to trick people into sharing personal information. One common scam is account takeover fraud. This is when someone gains access to your account and makes unauthorized transactions. At BankChampaign, your security is our priority. Here’s how these scams work and how you can protect yourself.

What Is an Account Takeover?

An account takeover happens when a scammer pretends to be your financial institution – often using realistic texts, emails, or phone calls – to get your personal details. Once they have your information, they can lock you out and drain your funds.

How It Works

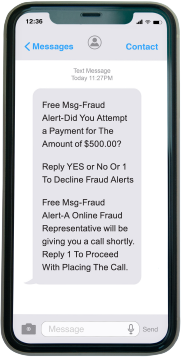

Fraudsters typically start by sending a fake text message that looks like it’s from your bank.

They may follow up with a phone call pretending to be from the “fraud department,” asking for your login or verification codes to “cancel” the payment. Once they have that info, they can access your account and move money without your consent.

BankChampaign will never call you to request your account number, online banking credentials, or verification codes.

Do not reply, click links, or call numbers in suspicious messages. Account takeover fraud usually begins on a Friday, after business hours, and runs through the weekend.

Everyday Habits to Stay Protected

Small actions can help you stop fraud before it starts:

Think Before You Respond

If a message or call feels off - it probably is.

Beware of Impersonation Scams

If a phone call, email or text message looks like it's coming from BankChampaign, but it is asking you to share your personal information, consider it fraud.

Avoid Suspicious Links and Messages

Don’t click unknown links or reply to unexpected texts or emails.

Never Share Personal Information Over the Phone

Hang up immediately if someone asks for personal information over the phone.

Create Strong, Unique Passwords

Use strong, unique passwords and update them regularly.

Enable Multi-Factor Authentication (2FA)

Add extra protection to your accounts by requiring a second verification step, like a text code or app, to keep your information secure.

Secure Your Devices and Networks

Protect your devices with updated antivirus software and avoid using public Wi-Fi for banking.

Safely Dispose of Sensitive Documents

Shred any documents containing personal information.

Regularly Monitor Your Accounts

Monitor your accounts frequently for suspicious activity and report concerns quickly.

I'm a victim of Identity Theft. What should I do?

When someone illegally obtains your personal information, such as your Social Security number, credit card number, bank account number or other identification and uses it to open accounts or initiate transactions in your name, they have committed identity theft. If this happens to you, follow these steps below:

Contact Us IMMEDIATELY

Contact BankChampaign immediately at 217-351-2870. We will secure your BankChampaign accounts and help with suggestions for your other financial relationships.

File a police report

File a police report with local authorities.

Contact the fraud departments

Contact the fraud departments of the three credit bureaus below. Place a fraud alert and request a copy of your credit report.

Trans Union: 800.680.7289

Experian: 888.397.3742

Equifax: 800.525.6285

File a complaint with the FTC

File a complaint with the Federal Trade Commission online or by phone at 877.438.4338

https://www.identitytheft.gov/